School of Business Valuation, Investment, & Real Estate

Curriculum designed by professionals and academics in valuation and financial analysis.

Description

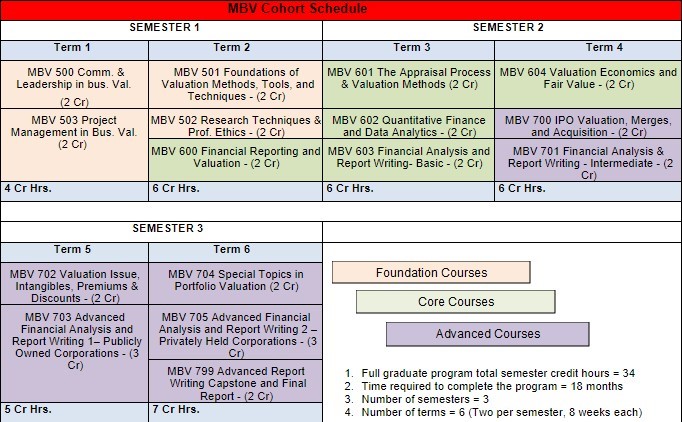

Dive into the enriching world of the Master of Business Valuation (MBV), an entirely online program thoughtfully crafted for completion in just 18 months. FUSE’s MBV presents students with an educational journey that seamlessly weaves theory with practical technical expertise, paving the way for a future as business valuation professionals in various fields, including accounting firms, investment banks, registered investment advisory firms, brokerage firms, valuation firms, and similar businesses.

1. Objective 1: Students will have the technical expertise to conduct high-quality business valuations upon graduation.

Intended Outcome: Upon graduation, students will be immediately employable in high-demand areas.

2. Objective: Students will be sufficiently trained to acquire certifications in the business valuation discipline.

Intended Outcome: Our program is designed to make your student experience as efficient as possible.

Students must be formally accepted into the MBV program and meet all graduation criteria outlined in the course catalog. Matriculated students must successfully complete the total of 34 credit hours listed above and maintain a 3.0 grade point average to graduate. If the Applicant falls below a 3.0 grade point average, the student will be required to re-take the most recent courses and to pay additional tuition. Under such circumstances, the most recent grades achieved are counted toward the cumulative GPA. Students may repeat each course only once. Students who have not been able to raise their grade point average to at least a 3.0 after re-taking a course will be dismissed from the program. Graduation is not automatic upon completion of requirements. All students are required to complete and submit an Application to Graduate to the President, along with the requisite fees.

School Of Business Valuation Investment and Real Estate

The Master of Business Valuation (MBV) is one of the many programs offered at FUSE. This program is a fully online program designed to be completed in 18 months. FUSE’s MBV provides students with an educational experience enabling them to work as business valuation professionals in accounting firms, investment banks, registered investment advisory firms, brokerage firms, valuation firms, and other businesses similar in nature.

Total Terms:

4 Terms

School Program:

MBV

Total Students:

100+

What Will You Learn?

Unlike the traditional model of enrolling in specific topic courses, of which parts are outdated or irrelevant to the needs of specialists, FUSE built a program that trains future valuation professionals from a practitioner’s point of view, without sacrificing the rigor of theoretical underpinnings, by integrating relevant portions of larger topics and simulating the workings of valuation firms by leveraging current software and databases.

![]() Provide an understanding of the foundational concepts of business valuation.

Provide an understanding of the foundational concepts of business valuation.

![]() Introduce you to the quantitative finance and data analytics field in business valuation.

Introduce you to the quantitative finance and data analytics field in business valuation.

![]() Provide an understanding of tools and techniques in advanced financial instruments to value intangibles, premiums, and discounts.

Provide an understanding of tools and techniques in advanced financial instruments to value intangibles, premiums, and discounts.

![]() Help in developing basic and advanced financial analysis report for publicly traded and privately held corporations

Help in developing basic and advanced financial analysis report for publicly traded and privately held corporations

![]() Evvery class is tied to a practical case study.

Evvery class is tied to a practical case study.

![]() Introduce you to Python programming and financial libraries to perform advanced financial data analysis.

Introduce you to Python programming and financial libraries to perform advanced financial data analysis.

Certification

Because the level of the first valuation report meets the organizational requirements, upon successful completion of the first Semester (two terms) of the program, students will receive the credential of Business Certified Appraiser (BCA) from the International Society of Business Appraisers (ISBA), a U.S. Small Business Administration “qualified source” to conduct small business appraisals.*

* Business credentials are trademarks of their respective organizations. The specific requirements and fees associated with these designations are available through the issuing organizations. FUSE cannot guarantee passage of any of these exams and individual students should prepare independently before attempting the assessments.

Selected Courses From This Program

Semester 1- Foundation Courses (500-599

MBV 500 Communication and Leadership in Business Valuation: (2 credits)

MBV 503 Project Management in Business Valuation : (2 credits)

MBV 501 Foundations of Valuation Methods, Tools, and Techniques: (2 credits)

MBV 502 Valuation Research Techniques and Professional Ethics : (2 credits)

MBV 600 Financial Reporting and Valuation : (2 credits)

In this semester, graduate students will gain a strong foundation in Information Technology, covering key elements such as information processing, retrieval, and storage, with a focus on practical concepts for programming and operating systems. The course also includes essential aspects of IT project management, emphasizing stakeholder engagement, team performance, adaptive planning, and agile principles. Additionally, students will explore fundamental principles of enterprise architecture and its application in achieving business goals through situational case studies and the architectural development method.

In this semester, graduate students will develop a solid understanding of business intelligence and data analytics fundamentals. The course equips students with practical skills in applying BI and DA tools to interpret and analyze data sets, emphasizing stakeholder collaboration and the decision-making framework. Additionally, students will delve into database management systems, covering architecture, data models, manipulation, and environments, applying industry-relevant development practices. The curriculum also provides an overview of the knowledge, tools, and techniques essential for analyzing big data, with a focus on skills for importing/exporting, cleaning/fusing, modeling/visualizing, and analyzing/synthesizing datasets.

Semester II -Core Courses (600-699)

MBV 601 The Appraisal Process and Valuation Methods: (2 credits)

MBV 602 Quantitative Finance and Data Analytics : (2 credits)

MBV 603 Financial Analysis and Report Writing- Basic : (2 credits)

MBV 604 Valuation Economics and Fair Value: (2 Credits)

MBV 700 IPO Valuation, Merges, and Acquisition : (2 credits)

MBV 701 Financial Analysis and Report Writing – Intermediate: (2 Credits)

Semester III -Advanced Courses (700-799)

MBV 702 Valuation Issue, Intangibles, Premiums & Discounts : (2 credits)

MBV 703 Advanced Financial Analysis and Report Writing 1– Publicly Owned Corporations : (2 credits)

MBV 704 Special Topics in Portfolio Valuation : (2 credits)

MBV 705 Advanced Financial Analysis and Report Writing 2 – Privately Held Corporations: (3 credits)

MBV 799 Advanced Report Writing Capstone and Final Report : (2 credits)

In this semester, graduate students will gain expertise in cyber intelligence and operations, covering principles such as risk mitigation, network security, security architecture, security operation, and development security. The course emphasizes the practical application of industry protocols across security knowledge areas and domains. Additionally, students will explore computer forensics principles, tools, and techniques, simulating practices related to digital risks, counterattacks, intellectual property, and privacy issues. Legal case studies are examined to illustrate the application of computer forensics in law. The course also addresses the principles of malware analysis and equips students with skills to defend organizations against cybersecurity issues as a malware author. Through investigating electronic crime cases, students learn how to effectively defend against malware attacks.

In this semester, graduate students will acquire a foundational understanding of information and communication technology (ICT) and its practical application in both technical and business contexts. The course, grounded in research, challenges students to identify and solve problems while considering cost and resource constraints. It covers the fundamentals of cloud infrastructure, including services like Amazon Web Services, Microsoft Azure, and Google Cloud, with a focus on Linux environments. Students gain hands-on experience with essential APIs and tools for building, deploying, and maintaining applications in the cloud. The curriculum also encompasses principles of enterprise network management, exploring policies, operations, and various management processes, while emphasizing information processing techniques and emerging trends in network management.

Telecommunication/Infrastructure Specialization

MS-ICT662 ICT Technical Foundations: (3 credits)

MS-ICT672 Cloud Computing: (3 credits)

MS-ICT682 Wireless Technology: (3 credits)

MS-ICT692 Network Management, Policy, and Operation: (3 credits)

MS-ICT697 Network Security: (3 credits)

MS-ICT700 Capstone in Telecommunication and Infrastructure: (3 credits)

SOFTWARE ENGINEERING (SE). Specialization

MS-SE663 Foundations of Programming Language and Software Development Concepts: (3 credits)

MS-SE673 Web and Mobile Application Development: (3 credits)

MS-SE693 Software Development and Testing: (3 Credits)

MS-SE693 Working on Enterprise Applications: (3 Credits)

MS-SE698 Open Source Software Architecture: (3 Credits)

MS-SE700 Capstone in Software Engineering: (3 Credits)

In this semester, graduate students will master programming fundamentals in various languages for software development, focusing on syntax, code writing, and debugging. The course covers tools and techniques for developing complex web and mobile applications, including the software development life cycle, agile methodologies, and security considerations. Students explore enterprise-scale software development principles, such as continuous deployment, integration, testing, and monitoring with feedback. The curriculum also introduces open source software architecture, including management tools and techniques. Through case studies, students examine intersections between open source architecture and business, law, product management, and software development, gaining insights into the roles involved in open source management and the process of building the proper architecture to support open source initiatives.

Florida University Southeast (FUSE) is licensed by the Florida Commission for Independent Education, License #5555. Inquiries may be directed to the Commission at 325 West Gaines Street, Suite 1414, Tallahassee, FL 32399-0400, phone: (888) 224-6684, email: cieinfo@fldoe.org. For FUSE compliance-related inquiries, please contact compliance@myfuse1.education.

1375 Gateway Blvd, suite 38

Boynton Beach, FL 33426,

USA

561-440-0253

info@myfuse1.education